Cardify Africa’s virtual dollar debit card offers a number of advantages over physical debit cards. Here are some of the key advantages:

- Convenience: With a Cardify virtual dollar debit card, there’s no need to carry a physical card around. This means that you can easily access your funds without having to worry about losing your card or having it stolen. You can use the virtual card from anywhere in the world as long as you have an internet connection.

- Security: Virtual dollar debit cards offer enhanced security features that physical cards do not. For example, the virtual card is not susceptible to skimming or other forms of physical theft. Additionally, virtual cards can be easily blocked and replaced if they are lost or compromised, providing added peace of mind.

- Accessibility: With a Cardify virtual dollar debit card, you don’t need to have a traditional bank account. This makes it an ideal option for people who are unbanked or underbanked. Virtual cards are also easy to obtain and can be activated within minutes, making them a convenient option for those needing quick funds access, although after the necessary KYC have been filled successfully.

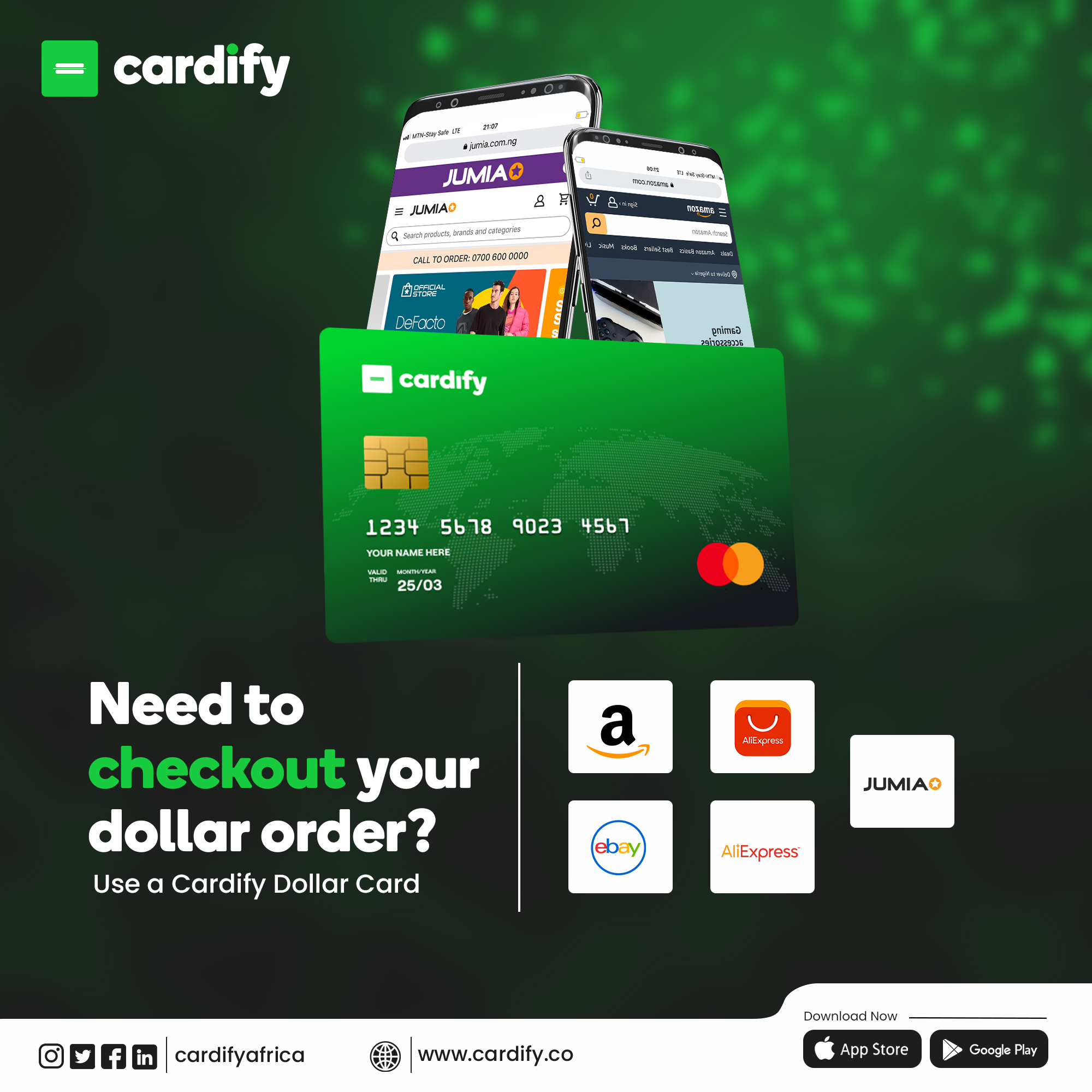

- Global Acceptance/ Usage: Cardify Virtual dollar debit cards are accepted globally, allowing you to use your funds anywhere in the world where debit cards are accepted for checkout. Here are some use cases:

- Online Shopping: One of the most common use cases of a virtual dollar debit card is for online shopping. You can use the virtual card to make purchases on e-commerce websites without having to reveal your actual credit or debit card details.

- Subscription Services: If you have recurring subscription services like Netflix, Hulu, or Spotify, you can use a virtual debit card to make payments without having to worry about the subscription auto-renewal or canceling the service.

- International Transactions: If you’re traveling abroad, you can use a virtual debit card to make international transactions without worrying about exchange rates or transaction fees.

- Budgeting and Expense Tracking: Using a virtual debit card can help you track your expenses and control your budget. You can load a specific amount of money onto the card and use it for specific expenses, and when the balance runs out, you know it’s time to stop spending.

- Protection against Fraud: If you’re concerned about credit card fraud, using a virtual debit card can provide an additional layer of protection. Since the virtual card is not linked to your actual bank account, even if someone steals your card information, they won’t be able to access your money.

- Gift Card Replacement: A virtual debit card can also be used as a gift card replacement. You can send the card to someone as a gift, and they can use it to purchase whatever they like.

- Budgeting: Virtual dollar debit cards allow you to set spending limits and monitor your transactions in real time. This can help you stay on budget and avoid overspending.

Overall, virtual dollar debit cards offer a number of advantages over physical debit cards. They are convenient, secure, accessible, globally accepted, and offer budgeting features. As such, they are becoming an increasingly popular option for people who want to manage their funds in a flexible and convenient way.