Making the Right Choice: Physical card or Virtual card? Security, Convenience, and Control

In today’s digital world, managing your finances online is more convenient than ever. But when it comes to making payments, you might wonder: virtual card or physical card? Both options have their pros and cons, and the best choice depends on your spending habits.

Physical Cards: Get familiar with a few drawbacks

Physical cards are widely accepted for both online and in-store purchases. You can easily swipe them at checkout counters and keep track of them in your wallet. However, they’re susceptible to loss or theft, which can expose your financial information. Additionally, physical cards can tempt overspending, as it’s easy to lose track of your transactions.

Virtual Cards: Security and Convenience all the way!

Virtual cards offer a secure alternative. They exist only digitally, eliminating the risk of physical theft. Generating and using them for online purchases is a breeze. They often come with spending limits, helping you stay on budget.

However, virtual cards might not be accepted by all merchants, especially for in-store transactions. Additionally, using them requires an internet connection.

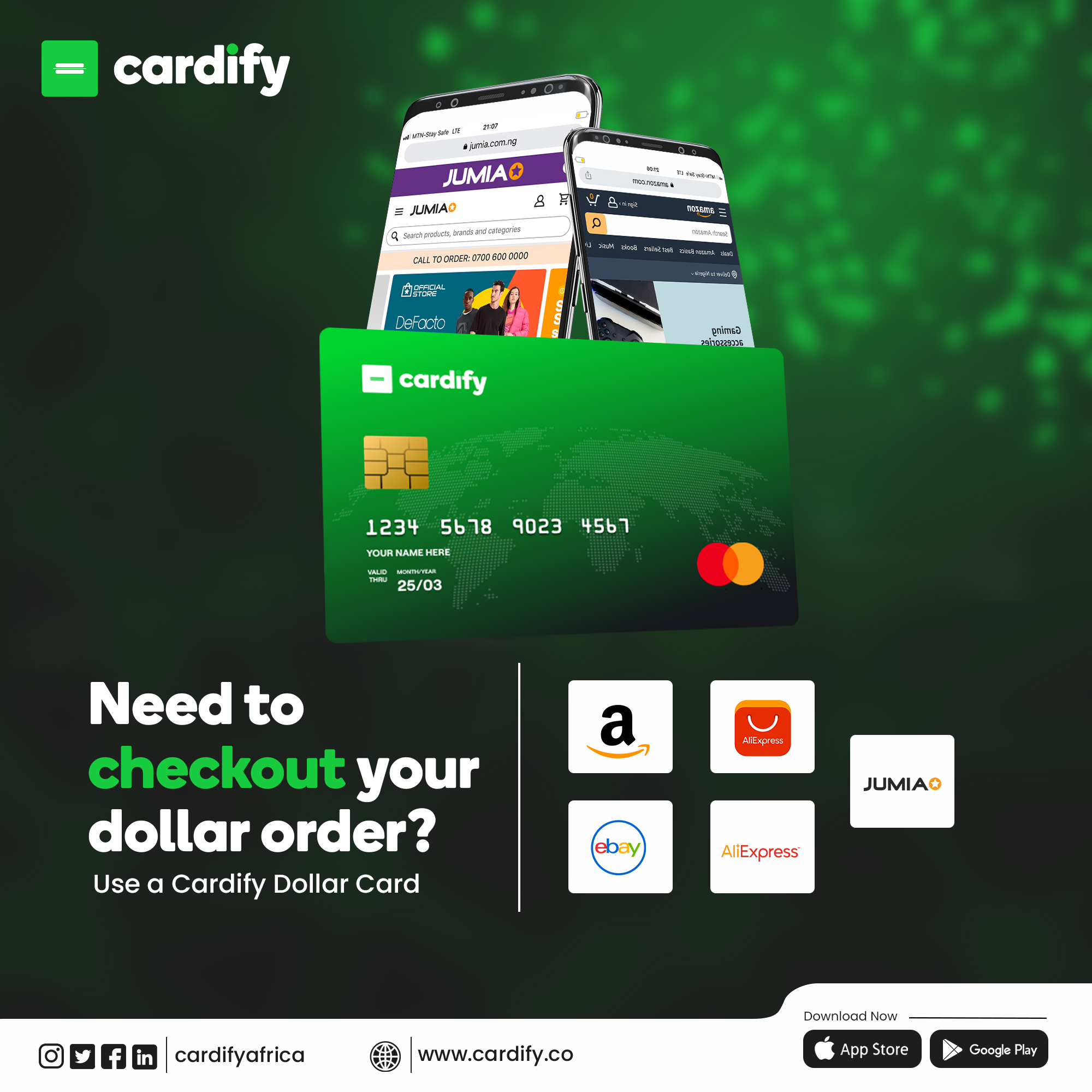

Cardify Africa: Your Virtual Wallet Partner

Cardify Africa understands the importance of secure and convenient financial tools. While they don’t offer physical cards at the moment, their virtual cards provide a reliable solution for managing your finances online.

Cardify Africa virtual cards come in two options: basic dollar Mastercard and standard dollar Visa. You can easily create and fund these cards using your NGN or USD wallets within the Cardify platform. This allows you to make secure international online purchases wherever debit cards are accepted.

Make an Informed Choice for Your Financial Needs

By weighing the advantages and disadvantages of virtual and physical cards, you can choose the option that best suits your spending habits. Cardify Africa’s virtual cards offer a secure and convenient way to manage your online finances, giving you peace of mind while you shop.

Conclusion

In the ongoing debate between virtual and physical cards, there is no one-size-fits-all solution. Each option offers unique advantages and disadvantages, catering to different preferences and lifestyles. Ultimately, the choice between virtual and physical cards depends on individual needs, priorities, and comfort levels with technology. Whether opting for the security and convenience of virtual cards or the familiarity and ubiquity of physical cards, users can leverage innovations like Cardify Africa to access a diverse range of financial solutions tailored to their preferences.

For more articles like this click here