Benefits and Challenges of Utilizing US Dollars on Cardify for Money-Saving in Nigeria

Introduction

In Nigeria, where inflation and currency fluctuations can challenge maintaining financial stability, exploring innovative ways to save money is essential. One such strategy gaining popularity is leveraging US dollars on platforms like Cardify. In this article, we will discuss how Cardify can help individuals in Nigeria save money and provide practical tips for maximizing the benefits of using US dollars.

Understanding Cardify

Cardify is a digital payment platform that allows users to store, transfer, and spend US dollars using a virtual card. With its user-friendly interface and robust security features, Cardify offers a convenient and reliable solution for Nigerians to manage their finances in a stable currency.

Advantages of Using US Dollars on Cardify

Currency Stability

One of the significant advantages of using US dollars on Cardify is the currency’s stability. The Nigerian Naira often experiences volatility, making preserving the value of savings challenging. By converting Naira to US dollars on Cardify, individuals can protect their funds from currency fluctuations and maintain purchasing power.

Access to International Markets

Using US dollars on Cardify gives Nigerians access to a broader range of international goods and services. Many online platforms and merchants accept US dollars, allowing users to take advantage of competitive prices, discounts, and exclusive deals not readily available in the local market.

Security and Convenience

Cardify offers robust security measures to protect user transactions and personal information. With encryption protocols and two-factor authentication, users can feel confident about the safety of their funds while enjoying the convenience of instant, hassle-free transactions.

Practical Money-Saving Strategies with Cardify

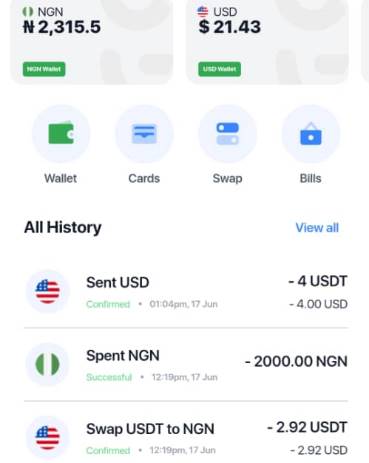

Budgeting in US Dollars

Create a monthly budget in US dollars to gain better control over your spending. Allocate funds for essential expenses, savings, and discretionary purchases. By keeping track of your spending in a stable currency, you can avoid impulsive buying and stay on track with your financial goals.

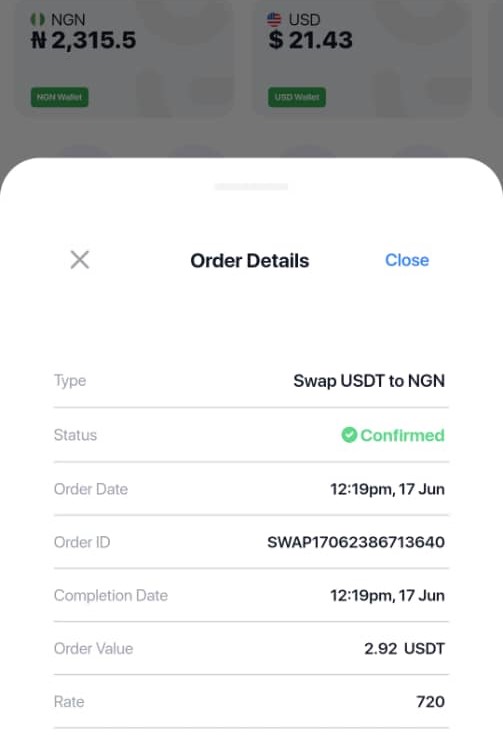

Take Advantage of Exchange Rates

Monitor exchange rates and convert your Naira to US dollars on Cardify when favorable rates are. Timing your conversions strategically can help you save money, as you’ll receive more US dollars for each Naira exchange.

Shop Online for Best Deals

Use Cardify to shop online and compare prices across different platforms. Many international retailers offer significant discounts, seasonal sales, and promotional offers that can help you save money on various products and services. Be sure to factor in shipping costs and any import duties when calculating the overall expenses.

Utilize Digital Wallets and Apps

Cardify integrates with various digital wallets and financial apps, allowing users to earn cashback, rewards, or loyalty points on their purchases. Explore these options to maximize your savings and make the most of your spending.

Set Up Automated Savings

Use Cardify’s automated savings feature to regularly set aside a portion of your US dollar funds as savings. This can be a great way to build an emergency fund or work towards long-term financial goals. Start small and gradually increase the amount you save over time.

Conclusion

In a country like Nigeria, where economic fluctuations can impact personal finances, leveraging US dollars on Cardify offers an effective strategy for money-saving. By utilizing the stability of the US currency and exploring the benefits of online shopping, budgeting, and automated savings, individuals in Nigeria can improve their financial well-being and safeguard their savings. Embracing digital payment platforms like Cardify opens new avenues for financial growth and stability in an increasingly interconnected world.